Advocacy

BIA works diligently to help safeguard the industry as called for in the Association's Mission Statement (to both promote and safeguard the industry.)

BIA does this through analysis of key policy issues, as well as practical programs to advocate for the brick industry position. This work is guided by BIA’s Government Affairs and Compliance committee, chaired by Brad Belden of The Belden Brick Company.

Leveraging Member Relationships

BIA employs a number of tools in its advocacy work. BIA leverages resources of staff and outside consultants as well as alliances with like-minded trade associations. But no tool in the arsenal is as important as utilizing and leveraging relationships of BIA’s active members.

Relationships forged by brick representatives with their legislators form the basis on which BIA can successfully advocate for common sense policies. There are many things BIA members can do to increase positive exposure for the industry and build or renew relationships with members of Congress back in their home districts. Foremost among these is hosting lawmakers at a brick facility.

Facility Tours stand as one of the most effective ways to establish or cultivate a relationship with elected officials. They afford the chance to increase lawmakers' understanding of: a) legislative and regulatory issues most important to brick the industry, and b) the industry’s many economic, environmental and community contributions.

A Capitol Hill Fly-In that brings BIA members to the offices of two dozen key Senators (e.g., Sen. Michael Bennet D., CO) and Congressional Representatives (Jim Jordan R., OH) can enable high-level dialogue and influence. In 2023, almost a dozen BIA members briefed Congressional staff and elected officials of the industry’s economic contributions and policy concerns:

- Boost the workforce;

- Increase access to affordable energy such as natural gas;

- Fight sizable tax increases; and

- Urge that Executive Branch regulating agencies focus on genuine risk.

Given the gravity of the key policy issues confronting the industry, it is critical that BIA members generously support Brick PAC for a Stronger America. Brick PAC is an FEC-regulated, bi-partisan political action committee disbursing money to campaigns of pro-Brick legislators. These leaders are critical in forging national policy that is sensitive to the brick industry’s needs. Contributions to Brick PAC enable BIA to support the reelection of pro-brick legislators. A typical Member of Congress needs to raise at least $2 million for every successful run for Congress. BIA is pleased that Brick PAC has seen increases in member contributions for five consecutive years.

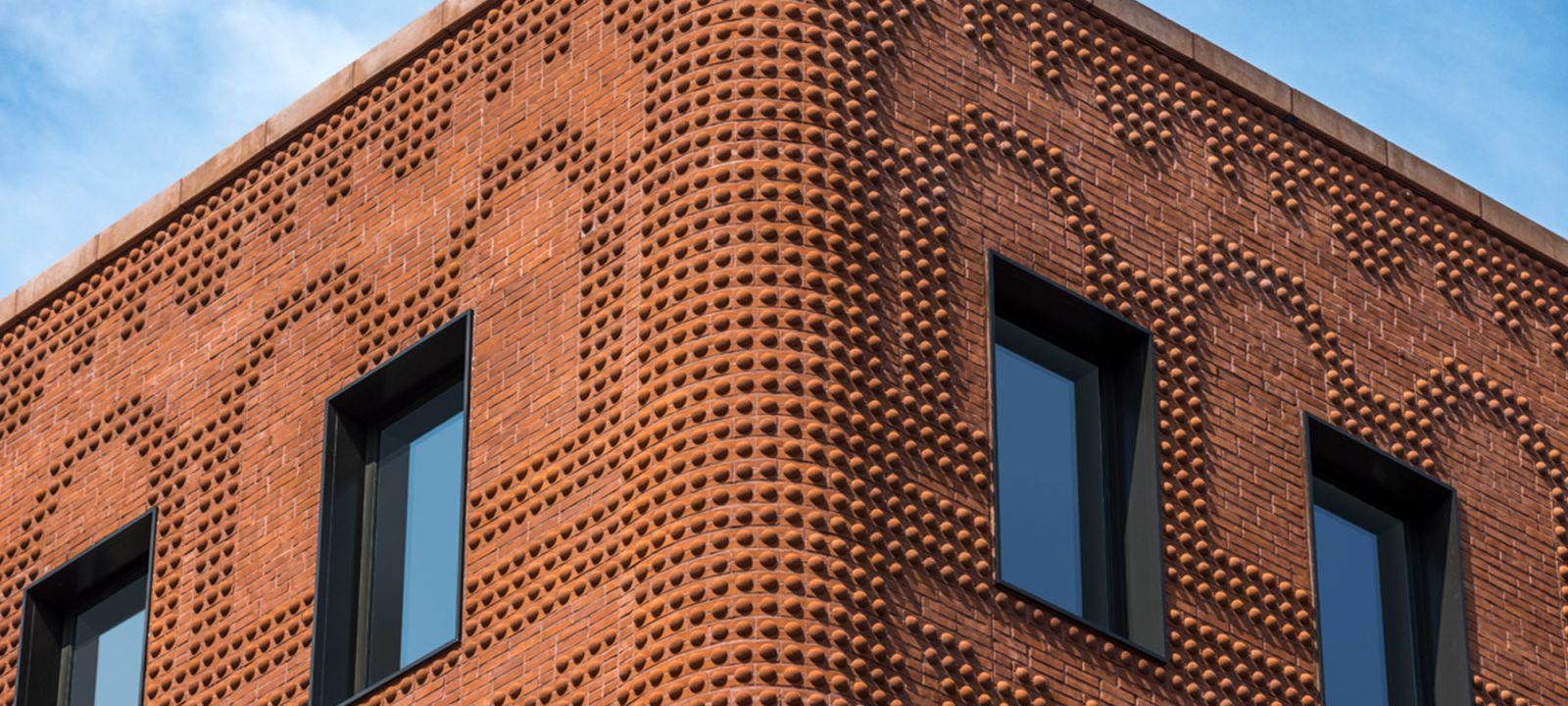

Local Planning Policies

Look at the communities that have stood the test of time - the neighborhoods that have kept their value, their beauty and their charm long after the builder and/or developer has made their money from the project. Many of these desirable communities – if not most – probably utilize a lot of brick. Many community planners want to ensure that their neighborhoods today stand for quality, attractiveness and strength.